Yearn Vaults are built with open standards and YFI partners have made amazing applications on top of them in the past couple of years. This article showcases how other protocols have extended Yearn products, and we hope it inspires more experiments on top of YFI services!

Example cases

The most common partnership cases are:

Using yVaults as collateral for lending/borrowing

Using yVaults to generate yield with user funds

In both cases, the partner is rewarded with performance fees taken from the vault’s overall profits, the more total volume that a partner contributes to a vault, the bigger share of the profit they receive. > # In 2021, Yearn shared $2,793,161 with partners through the partnership program

Let’s dive deeper now into our largest partner’s use cases:

Yearn + Abracadabra

Abracadabra uses yVaults in their borrowing service: The key innovation is accepting interest-bearing tokens as collateral for borrowing, when repaid the user receives the collateral vault tokens back which includes the profits that were generated over the time locked.

An overview of Abracadabra would be:

User deposits wETH (wrapped Ethereum, same as Ethereum) into a yVault, receives yvWETH

User deposits yvWETH on Abracadaba as collateral, Abracadabra allows the user to mint a percentage of their collateral as a dollar stablecoin called Magic Internet Money (MIM)

When the user mints MIM the collateral deposited gets locked until the MIM borrowed is paid back

If the user pays back in time then the collateral is unlocked, if it’s a yVault this would mean your yVault tokens get returned with all profits gained while they were locked!

If the user doesn’t pay back in time, part of your collateral will be used to pay for the service (liquidated)

Ideally, the interest generated by the vault token deposited will surpass the borrowing fee cost from Abracadabra

Yearn + Alchemix

Alchemix uses DAI (another dollar stablecoin, much like MIM) yVault in order to generate interest from user-deposited DAI and automatically repay loans.

User deposits DAI or ETH into Alchemix

Alchemix deposits DAI or ETH into Yearn Vaults to generate yield for the user (and automatically repay the loan taken next step).

User can borrow up to 50% of deposited collateral as DAI and up to 25% as ETH as alUSD or alETH (can be converted to DAI or ETH in Alchemix ecosystem) which locks the deposited amount proportionally to how much was borrowed

As the deposited amount in step 2 generates yield it pays back for the user loan automatically and the user can then withdraw proportionally to the yield generated

Here is the complete Alchemix ecosystem overview and how it integrates with Yearn:

yVaults in B2B

For business use-cases the Yearn DAO truly makes a difference: it has the infrastructure to provide the best vault security in DeFi at the moment.

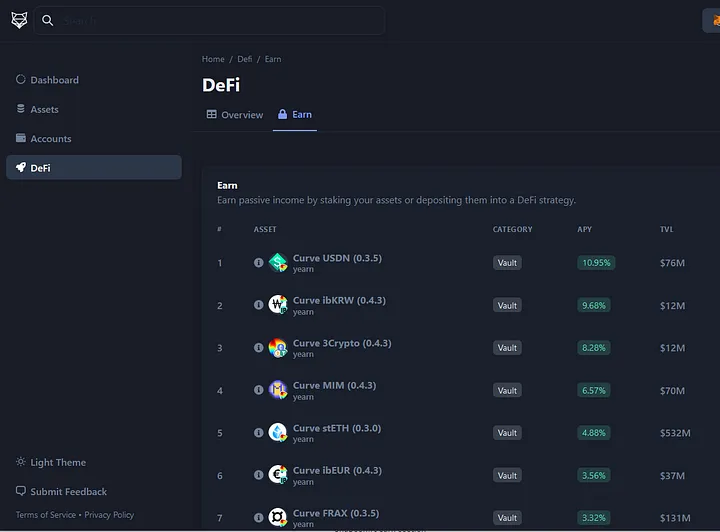

Partners earn a share of fees based on the TVL they contribute to the vaults, you can read more about our profit-sharing model in the Yearn Partner Documentation. Partner wallet apps and earn sections implement yVaults and serve them to users in different forms:

Earn Sections: pages that provide an alternative front for users to deposit their assets into yVaults. A good example of Earn section can be found on ShapeShift, their contract to deposit the assets at Yearn Vaults is open-source on GitHub

Wallets: partners provide Yearn yield generating options inside their ecosystem using yVaults. The SteakWallet is a good example of a wallet service that integrates with Yearn:

Resources to become a partner

If you would like to build on top of our yVaults it’s recommended to:

Read the Partnership Program documentation and follow-through the partner form

For technical guidelines check the Yearn Integration Methods documentation

We would love to hear from you about what you are building on top of $YFI protocols!

Producers: Worms, Reviewers: Corn, Dark Ghosty